A look into how supply chain issues translate into 2022 inflation

Last year was plagued with issues such as backed-up shipping ports, worker shortages, and rising costs continuing to disrupt the supply chain and create a lot of extra shopping complications for consumers and retailers.

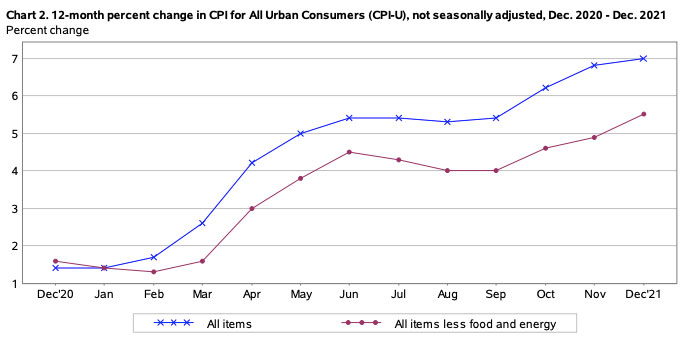

Many are anxious about the higher prices as inflation impacts us all. The consumer-price index, a measure of the price of goods and services from groceries to cars, jumped 7% for the 12 months ending December, according to the U.S. Bureau of Labor Statistics (BLS), the largest 12-month increase since the period ending June 1982.

The all items less food and energy index rose 5.5 percent, the largest 12-month change since the period ending February 1991. The energy index rose 29.3 percent over the last year, and the food index increased 6.3 percent. Mondelez International, which makes snacks like Oreos, Sour Patch Kids, and Chips Ahoy!, warned of its plans to raise U.S. prices by as much as 7% starting in January 2022.

How much longer will we see these large increases in prices? In the past, some of the holiday season supply chain bottlenecks start to ease and transportation volumes recede in January and February. Usually this means shortages get better and prices should start to back away from the highs they were reaching. However, this year is different as volumes continue to be at record levels and costs continue to push higher. This means it will likely take even more time for supply chains to unclog and to translate into lower prices for consumers. In the meantime, we will likely have to continue to cope with higher costs of living. Employers have faced a lot of wage increases to try to combat labor shortages and that could have a lasting effect on prices.

The Federal Reserve indicated in their recent news conference they believe the work force will return and inflation will decline. Their new economic projections are for inflation to be at 2.6% in 2022 and then to fall to 2.3% in 2023. And unemployment is seen dropping to 3.5% in 2022. The Fed plans on backing away from their pandemic monetary stimulus for the economy.

Time will tell if the Fed’s low inflation outlook is realistic. In the midst of any market or economic cycle, the transportation industry finds a way to keep goods moving. We believe that the supply chain disruptions aren’t going to go away overnight and are prepared to deal with the challenges ahead.

According to DAT Freight & Analytics, 2021 did not fare well in the freight market; from purchasing trucks and equipment to empty shelves. Access to new or used trucks has been very limited and even repairs to trucks have been backed up. Recent data from DAT shows the cost of used trucks nearly doubling in 2021, contract rates escalating, and the supply chain issues continuing to keep shelves bare. Access to rail freight and is also costing more and shipping containers are at an all-time high. Thankfully, it is not all doom and gloom. We are hopeful that The Federal Reserve’s positive economic projections are accurate.

Shipping capacity issues? Let us help you keep your shipments moving. Dupré operates approximately 750 trucks, employs over 1,100 professional drivers, and has established a network of 14,000 preferred carriers for its SCS group.